Blunomy brief: August 2025

Quantifying the Australian biomethane opportunity

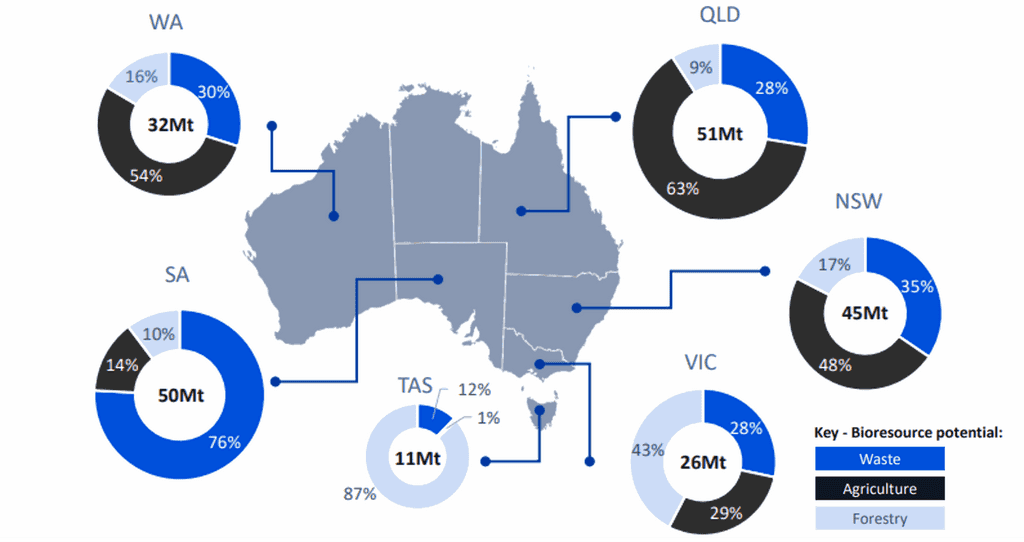

Biomethane potential by state (Souce: Blunomy analysis)

Blunomy is proud to have partnered with Energy Networks Australia (ENA) developing a report looking at the opportunity for biomethane to help decarbonise Australian industry. From accessibility to price and regional variation, here are some of our key findings on the potential for biomethane:

- Industrial users, like manufacturers and food processors, can switch to green gas without costly equipment changes and biomethane can flow through existing gas infrastructure, accelerating emissions reductions at lower cost than building entirely new transport and storage systems or retrofitting for compatibility with alternatives like hydrogen.

- Waste becomes opportunity: agricultural and food waste streams can generate revenue instead of cost.

- Blunomy's analysis shows that harnessing readily available organic waste streams could unlock around 400 PJ of biomethane each year, enough to meet up to 96% of today’s East Coast gas demand while leveraging the networks that already supply Australian industry.

- Critically, this transition can be cost-effective: the first 50 PJ of biomethane could be supplied at just AUD 10–27/GJ, a price range consistent with fossil gas over recent years.

Managing risk at the frontier of climate impacts: Blunomy's work with dairy supply chains

Dairy farming is deeply exposed to the risks of drought, heatwaves, and water scarcity that climate change is heightening, posing a threat to countless products that rely on sustainable milk supply. To tackle these challenges, Blunomy experts spent six months working with Danone and local farmers across Spain identifying climate risks, quantifying their impact and building a roadmap for supply chain resilience. We identified 5 key mitigating actions:

- Track and manage water use actively: Taking practical steps like tracking water bills and measuring water levels in wells to stay informed and compliant.

- Plan feed with future conditions in mind: Adjust diets to rely more on crops that grow well in their local area and are more resilient to heat and drought.

- Think beyond the farm gate: Growing feed uses more water than anything else in dairy farming – but often this happens off-site.

- Make every drop count: Re-using water to clean barns and improving how manure is managed, helping conserve water and reduce environmental impact.

Global resilience starts with local insight: Strengthening the resilience of its supply chain from where the impact is felt first is crucial

Green pulse

Recent deals and market developments that have caught our eye.

🟢 Green Hydrogen | H2 picks up: Hydrogen has had a bumpy year or two, with some of the hype dissipating: France and Portugal cut their 2030 electrolysis capacity targets by over 30% and around 45%, respectively, in April 2025; the UK shelved its 10,000-home hydrogen town heating pilot until at least 2026; and BP pulled out of the $55 billion Pilbara Renewable Energy Hub in July 2025. But the hype is being replaced by real progress:

- John Cockerill Hydrogen raised EUR 116M to support development of its electrolyser manu-facturing activity, following a EUR 230M raise in 2024 and breaking a recent cycle of negative news for European electrolyser manufacturers..

- Hynamics UK recently announced an agreement with Hy24 to co-develop a 120 MW electrolyser for ExxonMobil’s Fawley refinery.

🌱 Regenerative agriculture | RegAg gains pace: Regenerative agriculture is transitioning from concept to large-scale deployment, bolstered by both corporate programs (exemplified by recent announcements from Unilever and Pepsico) and nascent carbon markets.

- The biggest issue we see is that most of these RegAg proggrams are focused on farm-level measures, but the biggest problem is under the ground at acquifer-level.

- Water management is the biggest issue facing the transformation of the agricultural industry and the complexity of this aspect is not yet fully captured.

🏗️ CCUS | Concrete progress on carbon capture: Norway has become home to the first full-scale carbon capture system at a cement plant, a major step in decarbonizing one of the world’s most emissions-intensive industries.

- The carbon capture facility, located at Heidelberg Materials’s plant in Brevik, southeast Norway, is now capable of capturing up to 400kt of CO2 annually (roughly half of the site’s emissions).

Blunomy news

- Inspiring the next generation: Blunomy recently welcomed a group of children to our Paris office for a family day exploring the climate transition.

- We're looking forward to the annual ALLICE congress in September: a great opportunity to get back to the business of delivering the transition after summer holidays.

Want to talk about what these trends mean for your business? Reach out to the Blunomy team!